By: Trevor King

DISCLOSURE: This post may contain affiliate links, meaning this site may receive a commission if you decide to make a purchase through my links, at absolutely no cost to you. This please read my affiliate disclosure page for more information. Also, please read our article disclaimer

We could all use some extra cash in these difficult times. Setting financial goals and participating in different save money challenge ideas can help you achieve financial success. A savings challenge can be used to help you save for vacations, build an emergency fund, or save for a down payment on a home. You’ll need some financial motivation and a great money-saving challenge to get started.

WHAT IS A MONEY-SAVING CHALLENGE?

As the name implies, a money-saving challenge can help you remember your goals and stay on track. Regardless of which challenge you participate in, you will still save money.

MONEY SAVING CHALLENGE IDEAS TO TRY TODAY

52-Week Savings Challenge

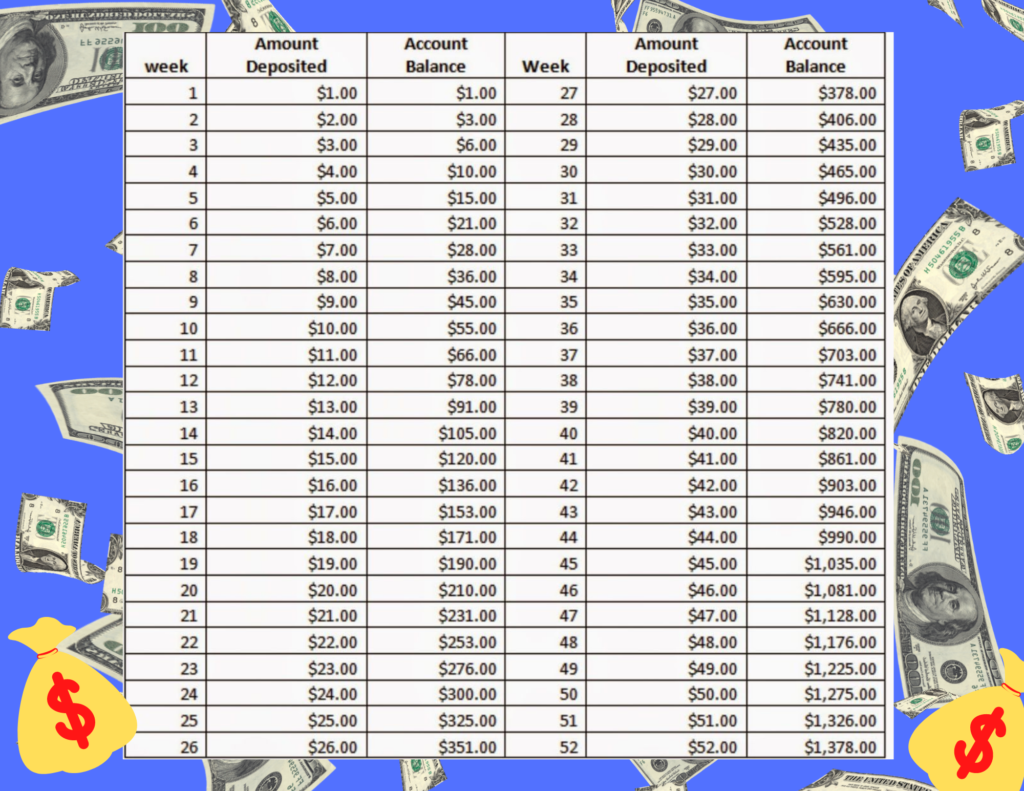

Long before social media allowed people to post money-saving challenges, there was this classic savings challenge. You can choose to save $1, $2, or $5 per week. You should be realistic and do something worthwhile. By saving $5 per week, you could have $260 by the end of the year. After a year, however, you won’t be as satisfied. If you save $100 per week for a year, you’ll have $5,200 at the end of the year. This money could be put towards vacations, holiday gifts, or an emergency fund. The 52-week savings challenge provides an excellent opportunity for experimentation. Some people will save $1 for the first week, $2 for the second, $3 for the third, and $52 for the 52nd week. If you did this, you’d save $1,378 over the course of the year.

MAKE EVEN MORE MONEY!

If you place these deposits into a bank account you will earn interest every month. However, you can invest your deposits in real estate or in stocks. That way you can possibly earn more for free. The best thing about free stocks, is that you can cash it in for cash, hold it and sell when it goes up, or let it serve as start to your portfolio.

The “No Spend Challenge”

It can be a lot more enjoyable than you think. You pick a weekend or a week that is the most difficult for you. You also don’t have to spend any money. You must make an exception for certain items, such as bills. You could also make a commitment to not spending any money for the weekend or the entire week unless common sense dictates otherwise. It is possible to save money by refraining from making purchases. It can also be a great deal of fun. You may need to come up with creative solutions if you can’t afford a particular tool. Maybe instead of buying new clothes, you’ll dig deeper into your closet. If you drive less and don’t fill up your car, you might find that you have more fun at home. For the pandemic, the no-spend challenge is ideal.

The meal-planning challenge for 30 days

Eating out is expensive. Lunch out costs $10-20 per day on average. This equates to about $2600 to $5200 per year. This 30-day savings challenge will allow you to pack your lunch 5 times a week and use meal planning to save money. You can also save money by not buying groceries that you don’t need.

Savings Challenge for $5

This is a fun money challenge that quickly accumulates funds. For the next 90 days, you can save $5 every time you receive a $5 bill. If you don’t use cash, you can add $5 to your savings account. To avoid overspending, invest in a cute piggy bag or container.

The Pantry Challenge

This is a great way to save money and is a subset of the “no spend” challenge. The pantry challenge requires you to declare that you will not buy food until all of your options in your fridge and pantry have been exhausted. Even if you don’t recall why you purchased the coconut oil and artichoke hearts, there was a reason. If the food isn’t expired, you can save money on it.

The ‘Keep All the Change Challenge’

Many people do this unofficially, but it could be formalized. In a jar, you can put any change you get at the store or find around your house. Continue doing this for a year and count how many you have. Then go to your bank or a coin-counting machine with the jar.

This modern take on the spare-change challenge could be accomplished by downloading an app like Acorns. Any purchase you make will be added up, rounded up, and then invested in a diversified investment portfolio by Acorns. Acorns charges a monthly fee of $1.

Extra Cash Challenge

Even if you don’t believe you have any extra money, there are ways to make it happen. This money challenge will motivate you to think outside the box. Any spare change in your car, purse, wallet, or house could be cashed in.

Alternatively, you could spend less on groceries and save the difference. You can declutter your home and sell any items you no longer need for extra cash. This is a fantastic way to step outside of your comfort zone and save money you wouldn’t normally do.

Challenge for the Christmas club

This is a fantastic way to save cash. To help you save money for Christmas, some banks offer a Christmas Club Savings Account. You can do it yourself with a dedicated savings account. You can use this account to save for anything you want. Credit unions are the most common providers of these accounts. This account type comes with a coupon book that you can use to make deposits. On November 1, your funds will be transferred to your designated account. There is no way to withdraw money from this account without incurring a penalty. It also keeps you from succumbing to the temptation to spend your money.

The ability to save money is essential for financial success. This will allow you to build up an emergency fund in case of unforeseen circumstances, as well as allow you to take the vacation you’ve always wanted. You can even challenge your friends to a money-saving challenge to get the accountability you need.

I hope this helps and that you participate in the Save Money Challenge. We have a “Making Money” category on this blog, but people fail to recognize, that if you save, you might not need to figure out how to make more money. Saving goes a long way!

*this is not financial advice

WELCOME! My name is Michael and I am the founder of Divide The Sea. Holding me back was the many unknowns and challenges in life and future. Once I made the decision to reach my life goals, I learned how to Fix My Credit, Make Money, Save Money, and Start A Business, my life was never the same. My goal now is to educate, because I find nothing more freeing than teaching others and seeing them change their lives like never before! No matter the difficulty, divide that sea and make it to your true destination.

Categories

Click Link Below For More Articles

Related Topics

Popular Blog Posts

About Michael

Michael is the founder of Divide The Sea. Many of us will not be educated in responsibility and preparing for the future. Michael saw this in himself and in his students. This website encourages those to divide the sea and make it to their destination. Here you can learn how to Fix Your Credit, Make Money, Save Money, and Start A Business

Please Subscribe To Our Newsletter!