By: Trevor King

DISCLOSURE: This post may contain affiliate links, meaning this site may receive a commission if you decide to make a purchase through my links, at absolutely no cost to you. This please read my affiliate disclosure page for more information. Also, please read our article disclaimer

Whether we spend money on unnecessary purchases or we don’t know how to manage our money, many of us find ourselves in a financial rut. That could be sudden or a slow bleed, like what happened to me. But there is hope and I really want to share how to save money fast! Saving money can be as simple as making small changes to your daily routine and learning how to use your credit card responsibly. This can be a literal course because there is so much information on the topic! Here are some tips that can help you save money and get back on track with spending.

Making A Budget

Before you can start saving, you need to know where your money is going. Whether it’s from bills or from spending money on shopping, a budget will help you learn where your money is going.

Once you have determined how much money you need for necessities and what little extra you want to spend, start setting up a budget that works for your lifestyle. The key is not to focus on the numbers, but rather to think about what items make sense in relation to your personal values and lifestyle.

Another way to get started with saving money is by cutting out one unnecessary purchase each month. For example, if you’re struggling with an expensive hobby (like golf) then maybe cancel your membership for a year or even trim down the amount of time that you spend at the club so that you can save more money.

Setting a budget and getting rid of one unnecessary purchase each month are great first steps towards becoming more financially responsible and finding ways to save more of your hard-earned cash—allowing it to grow into something amazing!

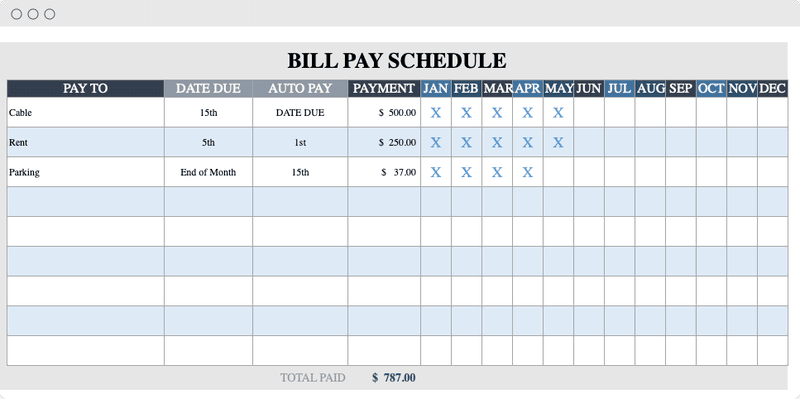

Example:

The first thing I did was make a spreadsheet. If you don’t have excel, use a free Google. software called Google Sheets (it’s free!).

On my spreadsheet, I start on the far left side. There I have my first column and I make a list of all my bills that have to get paid. I create more columns, such as Date Due, Auto Pay, and the Payment amount of those bills. The most important aspect to me are the columns of the month. After I pay a bill, I place an X to let me know that I paid the bill. On the last day of the month, I confirm all of my bills are paid. If not, I pay them. Even if I pay it my bills on the last day of the month, it won’t be recorded as late on my credit report because I paid within my 30 days. Don’t risk it, pay your bills on the due date!

This is how to make money fast. Having a budget, maintaining your bill payment, and monitoring where you are spending money. Cut out what isn’t necessary. It does not have to be permanent, just set a realistic goal.

SHOP SMART – BUY WHAT YOU NEED, NOT WHAT YOU WANT

When it comes to shopping, it’s easy to get tempted into buying what you need and not what you want. But, in order to save money, it’s important that we resist the urge to purchase everything that catches our eye. Don’t let yourself be swayed by the marketing tactics of stores or online retailers.

Instead, think about your priorities and buy what is truly necessary for your life. The more you give up on things that aren’t necessities for your life, the more money you will have to save.

GET CREATIVE WITH YOUR SPENDING

We all know that it’s easier to keep spending when we have cash in hand. But if you want to save money, the first step is to stop spending on impulse—pre-approving offers and discount codes can help curb your spending urges.

You can also get creative with your spending by not buying anything new. You don’t have to buy a lot of stuff; just put a small amount aside each month so you have some leftover cash at the end of the month. You can then use that money for one big purchase at the end of the year or two smaller ones throughout the year.

SAVE MONEY ON FOOD

Though food is necessary for living, going without can be hard. Even though you may want to cut corners on your food budget, you should never stop eating. To save money, purchase food in bulk or use coupons to help lower the cost of groceries.

Another way to save money is by preparing and cooking your meals in advance. Whether you’re cooking for yourself or for guests, prepping ingredients the night before will allow you to spend less time doing dishes and more time focusing on what’s important: getting your work done!

If you are finding it difficult to prepare new meals from scratch, consider purchasing frozen dinners that are quick and easy to cook. They are a great way to have a meal when you don’t have time for one on a busy day.

REDUCE YOUR ALCOHOL INTAKE

Alcohol is high in calories and can often contribute to weight gain. Not only that, but it also wears away at your bank account, as it costs twice as much on average than other types of alcohol.

To save money, consider cutting back on your alcohol intake. This will reduce the amount you spend each month and help you keep your spending in check. If you’re worried about being too hungover to work or go out after a night of drinking, try getting a second job that pays well and lets you take time off for recovering.

SAVE MONEY ON TRANSPORTATION

A lot of us spend a lot of money on gas. That’s because, unfortunately, it’s too easy to get distracted and go out for a drive when you don’t need to. Instead of getting behind the wheel and driving around aimlessly, try parking your car in a garage or parking lot for free. If you’re not sure where you should park, use an app like ParkMe that tells you how much parking is available nearby. You can also save money by taking public transportation whenever possible. Not only does this save gas and time, but it also helps the environment.

FIND THE CHEAPEST GAS STATIONS

One of the easiest ways to save money on gas is to find the cheapest gas stations near you. Depending on where you live and at what time of year, prices for gasoline can range dramatically. If you find a cheap gas station, it’s worth checking out how many miles per gallon your vehicle gets. If your car gets better mileage at one station than another, then it may be worth switching.

Another tactic that can help you save money on gas is purchasing a fuel-efficient vehicle. Since fuel economy is based on the size of the engine, it’s important to research which vehicles are most efficient before buying a new car or even getting an older model serviced and scheduled for repairs.

My brother uses an app that gives him money for every gallon he purchases. This year, he is on his way to making a thousand dollars. Read my related Article “How to save money using apps”

This will help you save money fast and overtime, a lot.

USE PUBLIC TRANSPORTATION

If you can, use public transportation whenever possible. If you live close to work, a bus or train is a cheap and easy way to get there. If you’re not close enough for that, consider carpooling or asking your friends if they want to split gas and driving expenses with you.

If you drive regularly, consider installing a GPS navigation system in your car so that your route becomes more predictable. You’ll save money by avoiding unexpected traffic jams or parking fees along the way.

By setting up an automatic payment of your bills online, you can avoid late fees and penalties if you don’t pay on time.

I grew up in Chicago and I loved the train. It was pretty expensive to commute on a daily basis, but it was cheaper than a car. I also saved money on buying a 30 day unlimited pass. There were promotions took advantage of as well. I was always looking for how to save money fast or at least in the long run.

RIDE-SHARING APPS

It’s a widely known fact that ride-sharing apps take the stress out of commuting. You don’t have to worry about traffic, parking, or whether or not you’ll get where you need to go.

But with ride-sharing apps like Uber and Lyft, you also don’t have to worry about your money.

Ride-sharing apps give users the ability to pay for transportation using their credit cards instead of cash. So if you’re planning on taking a taxi or bus home from work this week, try using one of these services instead!

I use Uber and even now, I never get it exclusively, I have no shame getting an Uber pool. I save in anyway. Seriously, always think “how can I save money fast?” Then act on the answer.

CONCLUSION

The best piece of advice for saving money quickly and easily is to cut back on small purchases. There’s no need to wait until payday to start saving – save every day. Try monitoring your spending closely, with a budget or journal, and be sure to focus on the small purchases that can make a difference to your overall balance. Think about how much you spend on coffee a year. Make it at home.

I hope I answered the question of how to save money fast. Let me know what other ways I can save money.

WELCOME! My name is Michael and I am the founder of Divide The Sea. Holding me back was the many unknowns and challenges in life and future. Once I made the decision to reach my life goals, I learned how to Fix My Credit, Make Money, Save Money, and Start A Business, my life was never the same. My goal now is to educate, because I find nothing more freeing than teaching others and seeing them change their lives like never before! No matter the difficulty, divide that sea and make it to your true destination.

Categories

Click Link Below For More Articles

Related Topics

Popular Blog Posts

About Michael

Michael is the founder of Divide The Sea. Many of us will not be educated in responsibility and preparing for the future. Michael saw this in himself and in his students. This website encourages those to divide the sea and make it to their destination. Here you can learn how to Fix Your Credit, Make Money, Save Money, and Start A Business

Please Subscribe To Our Newsletter!