By: Michael Sava

DISCLOSURE: This post may contain affiliate links, meaning this site may receive a commission if you decide to make a purchase through my links, at absolutely no cost to you. This please read my affiliate disclosure page for more information. Also, please read our article disclaimer

The core of this entire website is the be a mentor and educator in areas where school did not! School never taught us how to fill in a check! There is no reason to learn the hard way, because if you mess up filling in a check, it may not be cashed. Then there ar fees, your late payment may hit your credit score, lights much shut off, whatever! Learn how to learn how to write a check from the start. That way there is no issues when it’s time to pay for what you want to pay for!

What Is on a Check?

Checks are a common way to pay for goods and services. They can also be used to pay your bills, such as rent or mortgage payments, utilities, and insurance premiums.

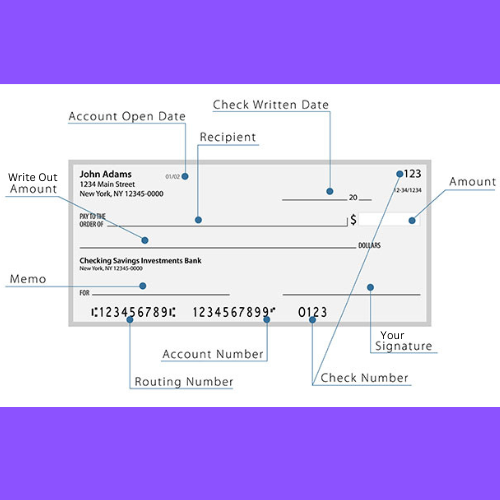

A check has various parts:

The top part is the check number. This number identifies the check so that it can be processed correctly by the bank, but it doesn’t affect how much money you have available in your account.

The middle part is where you write how much you are spending or paying out. This is called the “payee” line, which means you’re paying someone else with this check. You may have multiple payee lines on one check if you make multiple payments.

The bottom is where you sign your name and write your bank account number (or routing number). The signature guarantees that you authorized this transaction and will pay back any money taken from your bank account if there is not enough money in it when the transaction goes through. The bank also uses this information to process your payment or withdrawal as soon as possible.

Below we will talk about what you have to do, step by step to fill in a check. I created an image for you as well. That will have everything labeled for you and what you should write there.

How To Write A Check

Whether for a car loan or mortgage payment, tuition payments, or daily expenses, checks aren’t going away anytime soon. That said, many banking institutions opt for electronic payments over physical checks, and fewer people use them each year. Still, there is always a good chance that the recipient will want a paper check instead of an electronic payment, and business owners will continue using checks for external vendor payments and record keeping. If you’ve never written a check, don’t worry! It is relatively easy in most cases. However, if you’re on the fence about how to set up your checkbook register correctly, this guide can help.

How to Write a Check in 6 Steps

Here are the basic steps you should follow to write a check:

Step 1: Date the check

Enter the date on which you are writing the check. The date should be in the same format as the month, day, and year. For example, if you want to write a check on July 15th, you should enter “15 JULY” in this field. If you do not enter this information correctly, your bank may refuse to accept your check.

Date the check in a manner that is clear and easy to read. Do not use abbreviations such as “7/1/22” or “070122.” While some banks may accept this format, it can be confusing for other institutions and result in your check being returned for insufficient funds or insufficient information. Instead, write out the month and day, followed by the year, July 1, 2022. So far so good in filling out a check!

Step 2: Fill out who the check is for

This field is for entering the name of the person or entity receiving payment from your bank account. You should also fill out who the check is made payable. The person or entity receiving payment will be referred to as the payee on your check. For example, if you are writing a personal check, you would fill out their name and address information where it says “Pay To The Order Of.” If you are writing an electronic funds transfer (EFT), the payee would be the financial institution’s routing number and account number, such as the bank account number XXX-XXXX-XXX. To fill out this field accurately, use capital letters and proper spelling of both first and last names.

Step 3: Write the dollar amount in numbers

The amount should be written on line one and start with a word such as “Twenty”. When you get to line two, start writing numbers and decimal points. If you are writing more than one number, separate them by commas.

Write the numbers from left to right and top to bottom, using numerals only. Don’t use commas or decimal points; it’s assumed that there are two digits after every dollar sign, for example, $1,000. The number must be written as it appears on your bank statement, e.g., if you have $2,000 in your account but only $18 left after paying bills this month, write “$1,982”).

Step 4: Write the dollar amount in words

Write out the dollar amount as several words, i.e., one thousand dollars. If using a standard business check with preprinted amounts, there will be two blank lines after each word. If using a personalized or custom design, you’ll need enough space at the bottom of your check to fit all four digits of your desired amount without abbreviating them.

Step 5: Fill in the memo

The memo line should include an explanation or reference number so that whoever receives your check knows what it’s for. The easiest way to remember what to put there is to think about why you are writing it in the first place. For example, if you were writing a check for groceries at the market, you could put something like “Groceries” or “Food.” If you were writing a check for repairs on your car, you could put “Car Repair” on your memo line instead. In order to fill out a check, this is not mandatory, however if you are someone who writes a lot of checks, it may be good to help in organization or to avoid problems. Once a Landlord told me he didn’t get July’s rent. I went into my returned checks and found that it was cashed. I knew this because in the memo I wrote, “July’s Rent”, if I just had a bunch of checks with no memo, it would have taken much longer to do the research.

Step 6: Sign the check

If you’re writing a paper check, sign both below your printed name with a pen or pencil. If you’re using an electronic check, enter your name and signature into your software as directed by your bank or financial institution.

Signing your name on the back of the check signifies that you agree to cover the amount written on it with funds from your bank account.

Below is an image you can use to fill in a check. It’s the perfect example to write a check. Take your checks and compare it to this. You will see that it is very much the same!

How to Endorse a Check

You can endorse a check in several ways:

Blank Endorsement

A blank endorsement is when you sign the back of a check to indicate that you are endorsing it to someone else, but you do not fill out any details regarding who should receive the funds. This is often done when making payments to other people or businesses and is often considered the equivalent of handing someone cash. A blank endorsement allows you to hand off your check without worrying about other people having access to your account information or account number. The person receiving the check will be able to cash it at their bank, but they will not be able to use it as a form of payment for anything else that requires an account number or routing number, such as online bill pay.

Secure Endorsement

A secure endorsement is when you sign your name on the back of a check and include the name and address where it should be deposited. If you have this type of endorsement on your check, then whoever cashes it can only deposit it in their bank account or an account they are authorized to use by you or someone else.

Third-Party Endorsement

Third-party endorsement is when a person endorses a check on behalf of someone else. This can be done for several reasons, but it’s most commonly done when someone has authorized another person to write checks on their behalf.

This is often used in situations such as when people are buying items online and want to pay with a check instead of cash or debit card which requires entering sensitive card information. The seller will then deposit the check into their own account and ship out their merchandise once they receive payment confirmation from their bank.ent

Don’t Get Petty With Your Checks (quick story).

There is a viral story a few years ago that started with the divorce of a husband and wife. The husband was ordered by the court to pay his wife alimony. He wanted to move on with his life, but like most of us, it’s just not that easy once hurt by someone you love. After the man remarried a woman he had met after his divorce, his ex-wife wanted him back. However, he couldn’t go back to a woman that cheated on him. After months of a rocky marriage, arguments, broken hearts, and even emotional turmoil the man wanted to continue the argument. He continued to send alimony checks, but he made custom checks with a background photo of his new wedding photos. OUCH!

Conclusion

Including all of the required information and ensuring that it is all written legibly increases the chances of a recipient’s acceptance of your check. In general, the smallest formality in your check writing can lead to less confusion between you and the person who receives it. Before submitting your check to any recipient, ensure it contains all the appropriate information.

WELCOME! My name is Michael and I am the founder of Divide The Sea. Holding me back was the many unknowns and challenges in life and future. Once I made the decision to reach my life goals, I learned how to Fix My Credit, Make Money, Save Money, and Start A Business, my life was never the same. My goal now is to educate, because I find nothing more freeing than teaching others and seeing them change their lives like never before! No matter the difficulty, divide that sea and make it to your true destination.

Categories

Click Link Below For More Articles

Popular Blog Posts

About Michael

Michael is the founder of Divide The Sea. Many of us will not be educated in responsibility and preparing for the future. Michael saw this in himself and in his students. This website encourages those to divide the sea and make it to their destination. Here you can learn how to Fix Your Credit, Make Money, Save Money, and Start A Business

Please Subscribe To Our Newsletter!