By: Michael Sava

DISCLOSURE: This post may contain affiliate links, meaning this site may receive a commission if you decide to make a purchase through my links, at absolutely no cost to you. This please read my affiliate disclosure page for more information. Also, please read our article disclaimer

I graduated from law school in May of 2020. The bar exam was pushed back 3 months due to Covid-19 and nobody was hiring. I already used up my savings and all of my student loan to pay expenses. I’ll be upfront, I went broke. I fell behind on a substantial amount of medical bills and maxed out my credit cards trying to stay a float. My credit score tanked and I was put in a very difficult situation. So, I had to learn how to improve my credit score.

STEPS I TOOK TO FIX MY CREDIT

Bad credit can literally ruin your life. They may seem like a dramatic story and it is. Think about it, bad credit can stop you from purchasing something as simple as a decent phone. If you don’t qualify for a beat up phone, do you think a bank is going to give you a home or car loan? If they do take a chance on you, you’ll be guaranteed to be paying high interest rate, literally tens of thousands of dollars more than those with decent or better credit. Think about it, these companies need to make money off of us who need them, so they can purchase airline miles and cash back for the customers who don’t need THEM! So, let me teach you how to improve your credit score.

It’s highly recommended to never delay fixing your credit. It takes time to improve credit and in many cases, you may need the help of certified professionals. AIA Credit Repair, states “when you search online and people promise results in 24 hours, 1 week, or even in a months time, find another source of information. It’s not possible!” I learned that repairing my credit was an action I had to take almost immediately as well as a daily plan of action that I was committed to act in (forever)!

This is what I did to improve my credit 197 points:

Step 1: Make a Spreadsheet

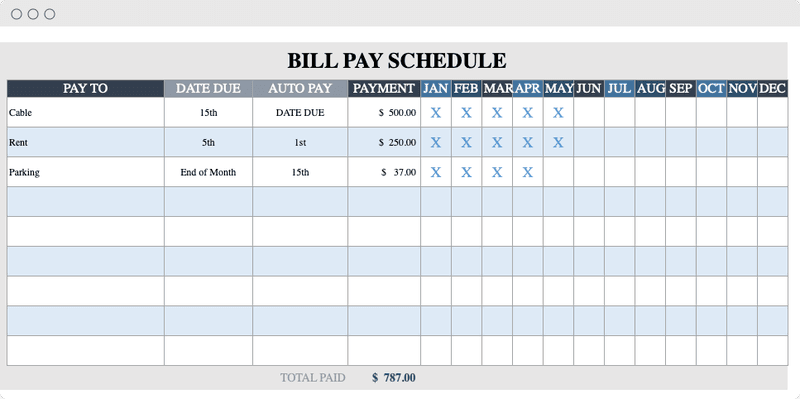

The first thing I did was make a spreadsheet. If you don’t have excel, use a free Google. software called Google Sheets (it’s free!).

On my spreadsheet, I start on the far left side. There I have my first column and I make a list of all my bills that have to get paid. I create more columns, such as Date Due, Auto Pay, and the Payment amount of those bills. The most important aspect to me are the columns of the month. After I pay a bill, I place an X to let me know that I paid the bill. On the last day of the month, I confirm all of my bills are paid. If not, I pay them. Even if I pay it my bills on the last day of the month, it won’t be recorded as late on my credit report because I paid within my 30 days. Don’t risk it, pay your bills on the due date!

The reason for this is to get organized, because this maybe one of the most important aspects to restoring your credit. It is crucial to pay all of your payments on time and build a good paying credit history. After a few months, you’ll start seeing an increase to your credit score. Keep it up and it will help you a great deal.

Step 2: Make Sure Your Credit Reports Are Accurate

Did you know that over 1/3 of the U.S. population has at least one error on their credit report? That was shocking when I found out about it. Personally, I had so many mistakes, I called AIA Credit Repair for help. I learned that fixing mistakes on your credit report can help you quickly improve your credit score. So don’t be shy, there is no time for it! Grab a pen or pencil and copy down these three pieces of advice from us:

1) Always check for errors on your annual credit report and/or enroll in one of the a credit monitoring service. If you enroll into a credit monitoring service, you should monitor your credit report daily.

2) Dispute that error since this would decrease your ability of having higher scores based upon newer criteria established FICO.

3. Continue to be patient because this will cause you a lot of frustration. That understandable, mistakes on your credit report is an injustice. Luckily, the law is on our side to fight back. Be patient and observe how you can improve your credit score over time.

3. Maintain Low Utilization on Your Credit Score

This is very important, this is what got my credit to plunge. In fact, this is the second major factor in determining your credit score. Credit utilization is the portion of your credit limits you use at any given time. A good rule-of thumb is: Use less than 20% on any card, or lower for better results! The highest scorers only use 7% of their credit limit amount. The best thing to do is keep utilization low, while you continue to pay off balances before they cycle or even make several payments. I am not saying to not use your card, be sure to actually use your card, not charging anything on your card can lead to the Credit Card Company closing your account and that will not improve your credit score.

4. Ask For A Higher Credit Limit

This works well with number 3. The higher the credit limit, and the less you use, the better your score. So, get aggressive, call your bank or credit card company and ask for a credit limit increase. Now, this might not work if your late in payments and maxed out on your credit cards. Yes, you can try, but its better to wait until you are showing some promise on getting a hold of your finances.

5. If You Don’t Have A Credit Card, Get One (or if they cancel all your credit cards like me, get a new one).

My first credit card was given to me by my dad at 17 years old. It had a max of $300 and I felt as if it was the greatest gift of all time. I didn’t know he was helping me out by building my credit.

It is highly recommended that if you are wanting to improve your credit, to get a credit card. If you don’t have credit, you may be approved by some credit card companies with a higher interest rate compared to most cards. They may make you pay them an annual fee just to give you a credit card. How else do you expect them to pay people with good credit’s airfare in miles or give low interest rates to those people who don’t need credit.

I recommended getting a secured credit card first. A secured credit card is a credit card that requires you to provide a cash security deposit to open an account. I went to MB Financial (at the time), gave them $450 in an account. They gave me a credit card with a $450 limit. That way if I maxed it out and never paid, they didn’t loose money they would just keep my money. After a year, they gave me my $450 back and I still had the credit card. I never charged more than $45 dollars on it and paid that in full every due date. That really helped me improve my credit score.

6. Mix Up Your Credit

My credit score dropped the month I paid off my truck! Yes, I had a 4 year car note that I set up on Auto-Pay. They took their payment out on the 4th of every month. It was boosting my credit score, in a major way. It was improving my credit history. However, once it was paid off, there wasn’t a mix on my credit report. I only had a few credit cards. Thus your credit, like mine will drop.

So, let’s not not focus just on paying bills and getting credit cards. We need to focus on other forms of credit or in other words, how we are going to mixing up our credit. In general, you should know of two avenues that your credit score needs to keep at it’s peak:

- Installment Loan(s): are accounts such as home mortgages, auto loans, student loans, and other personal loans. These are loans with an end date and until that end there is a payment required over an equal amount of time (on the first of month or every Monday, etc).

- Revolving Credit: These are retail cards (like your Macy’s Credit Card) or like your credit cards. Here these is no fixed end date. This is just credit you can use for life.

Once you can get a healthy mix of credit, your creditors and credit bureau will see you taking care of your financial business. They will see you are taking your finances seriously and in their eyes, you’ll become someone who would pay them back if they approve you. This is a great way to improve your credit.

7. Ask For Help

I mentioned them before, but I really believe in Credit Saint’s work. They are a Veteran Owned, Family run Credit Repair Business in Chicago. They have clients all over the country and work with people in all situations.

They will go a few steps further than this article, they will (on your behalf), contact the credit bureau, creditors, and collection agents and will have them repair credit errors, delete late payments, and will delete other damaging information found on a credit report (foreclosures, Repos, etc). The best part is Credit Saint, gives you a full money back guarantee, if you don’t see results in 180 days!

I understand, you want to improve your credit score. The American dream is still here and in this country we can still make it. However, it’s hard. Who we are, where we are, and how hard we are willing to work makes a difference. However, in the credit game, it’s equal. Apply these 7 steps and never give up. Make it work, and watch your credit score improve. Good luck to you. Please let me know if these worked for you. I hope it changed your life like it did mine!

WELCOME! My name is Michael and I am the founder of Divide The Sea. Holding me back was the many unknowns and challenges in life and future. Once I made the decision to reach my life goals, I learned how to Fix My Credit, Make Money, Save Money, and Start A Business, my life was never the same. My goal now is to educate, because I find nothing more freeing than teaching others and seeing them change their lives like never before! No matter the difficulty, divide that sea and make it to your true destination.

Categories

Click Link Below For More Articles

Credit Repair Services

Related Topics

Popular Blog Posts

About Michael

Michael is the founder of Divide The Sea. Many of us will not be educated in responsibility and preparing for the future. Michael saw this in himself and in his students. This website encourages those to divide the sea and make it to their destination. Here you can learn how to Fix Your Credit, Make Money, Save Money, and Start A Business

Please Subscribe To Our Newsletter!